In addition to financial planning consultation, we offer traditional brokerage services and low-cost, fee-only asset management services to help our clients implement their financial plans.

Call for more information

800-321-1640

216-696-0167

Fee Schedule

| Alternative Investments Annually |

$ 125.00 |

| Annual Fee Waived for all Retirement Accounts |

No Charge |

| Annual Account Fee**see note |

$ 100.00 |

| Asset Delivery Request through DTC (Depository Trust Company |

$ 25.00 |

| Domestic Bank Wire |

$ 10.00 |

| Certificate Reject Fee |

$ 200.00 |

| Dividend Reinvestment |

No Charge |

| DTC In/Out (Depository Trust Company) |

$ 25.00 |

| Duplicate Statement and Confirms each |

$ 1.25 |

| Estate Valuation and Alternate cost basis |

No Charge |

| Exchange and SEC Fees Actual fee charged |

|

| Extensions |

$ 5.00 |

| Foreign Stock Movement (Depending on Security Based on Trade or Transfer) |

$ 140.00 |

| International Wire |

$ 75.00 |

| Investment Access Account Visa Gold Credit Card with Check Writing Annual Fee $125.00 |

$ 125.00 |

| (The annual fee is waived for clients who have $200,000 or more in assets within the Inv. Access Account) |

|

| Legal Deposit (Physical Certificates) |

$ 60.00 |

| Money Market Account (first 50 checks) $0.50 each check thereafter |

Free |

| Outgoing Account Transfer Fee (ACAT) |

$ 100.00 |

| Over Night Check |

$ 10.00 |

| Over Night Envelope |

$ 15.00 |

| Physical Certificate Deposit (per company) |

$ 25.00 |

| Physical Reorganization |

$ 30.00 |

| Postage and Handling |

No Charge |

| Retirement Account Termination Fee |

$ 120.00 |

| Returned Check |

$ 30.00 |

| Rule 144 Item and any pass through fees from the Transfer Agent |

$ 25.00 |

| Safekeeping Annually |

$ 100.00 |

| Statement Copy |

$ 10.00 |

| Stop Payment on Check (Money Market) |

$ 20.00 |

| Transfer and Ship Certificate (non DRS security only) |

$ 650.00 |

| Transfer on Death set-up (Free with “Brokerage Choice Accounts”) |

$ 50.00 |

| |

|

| Annual Fee charged to accounts valued under $100M (unless paperless) |

|

|

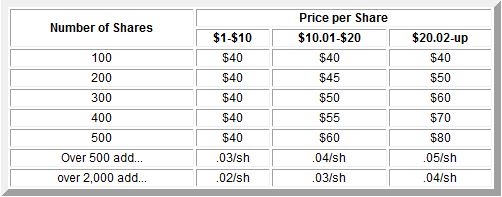

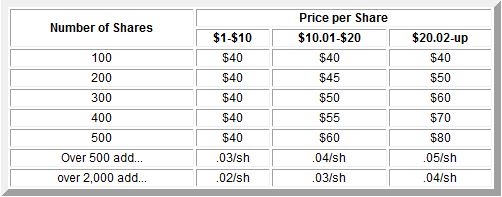

Commission based on same day trade. $40 minimum.

IRA and other Retirement accounts have no annual fees.

Securities and Investments Advisory Services offered through L. M. Kohn & Company A Registered Broker/Dealer, Member FINRA/SIPC/MSRB.

Securities in your account are protected up to $500,000 (cash up to $250,000) by the Securities Investor Protection Corporation (SIPC). RBC Capital Markets, LLC has purchased an additional policy covering up to $99.5 million per SIPC qualified account, subject to a maximum aggregate for RBC Capital Markets, LLC of $400 million. This protection applies to the physical loss or destruction of your securities; it does not apply to any decline in the market value of your securities. Other investments shown on your statement but not held at RBC Capital Markets, LLC may not be protected by SIPC or private insurance policies purchased by RBC Capital Markets, LLC. For more details, please talk to your Financial Advisor or call SIPC at (202) 371-8300 for a brochure or visit

www.sipc.org. |